Best Financial Advisor Tips and Tools for Smarter Investment in 2024

In today’s complex financial landscape, having expert financial advisor tips can make a huge difference in managing your money effectively. Whether you’re looking to save, invest, or plan for retirement, understanding the best practices from financial advisors is crucial. In this article, we’ll explore essential financial tips, benefits, and tools that can help you make informed financial decisions.

What is Financial Advisor Advice?

Financial advisors provide personalized advice to help individuals and businesses make sound financial decisions. This includes everything from investment strategies and tax planning to retirement savings and debt management. Financial advisors use their expertise to guide clients based on their unique financial goals and risk tolerance.

With technology making it easier than ever to access financial advice, many tools are available to help you follow expert tips without needing to meet with an advisor in person.

Benefits of Following Financial Advisor Tips

Financial advisor tips can provide a solid foundation for managing your finances. Here are some benefits:

- Personalized Guidance: Financial advisors help tailor strategies to fit your individual goals and financial situation.

- Risk Management: Advisors offer recommendations on diversifying your investments and managing risk to protect your assets.

- Long-Term Planning: Advisors can help you map out your long-term financial goals, such as retirement or saving for a large purchase.

- Financial Confidence: Following proven tips and strategies can give you confidence that you are on the right track with your financial goals.

Top 5 Tools That Offer Financial Advisor Tips

Here are five products that incorporate financial advisor tips and advice, helping you manage your finances more effectively.

1. Personal Capital

Product Overview:

Personal Capital is a comprehensive financial planning tool that allows users to manage both their personal finances and investments. It offers financial advisory services for high-net-worth individuals and also provides free tools for budgeting, retirement planning, and investment tracking.

Use Case:

Personal Capital is perfect for individuals looking to manage their entire financial life in one place. Whether you’re saving for retirement or monitoring your investment portfolio, it provides the resources needed to make informed decisions.

How to Buy:

You can sign up for Personal Capital’s free financial management tools or opt for paid advisory services on their official website. The app is also available for download on the App Store and Google Play.

2. Vanguard Personal Advisor Services

Product Overview:

Vanguard’s Personal Advisor Services combines the benefits of robo-advisors with access to human financial advisors. The service offers personalized investment advice, portfolio management, and long-term financial planning tailored to your goals and risk tolerance.

Use Case:

Vanguard is ideal for investors who want a mix of technology-driven investment advice and access to experienced financial advisors. It’s particularly beneficial for retirement planning and managing larger portfolios.

How to Buy:

Vanguard’s Personal Advisor Services is available through their website, with the option to connect with a financial advisor online or via phone.

3. Fidelity Wealth Management

Product Overview:

Fidelity Wealth Management offers personalized investment strategies through access to a dedicated financial advisor. It provides a range of advisory services, including retirement planning, tax-efficient investing, and estate planning.

Use Case:

Fidelity Wealth Management is ideal for individuals who want tailored investment advice and ongoing support from a financial advisor. It’s suitable for those with higher account balances who want specialized services for wealth growth and preservation.

How to Buy:

You can explore Fidelity Wealth Management services on their website or contact a Fidelity advisor for personalized advice. The platform also offers mobile access via apps.

4. Ellevest

Product Overview:

Ellevest is an investment platform designed specifically for women, offering goal-based financial planning and personalized investment advice. Ellevest uses financial advisor insights to create customized portfolios and offers one-on-one financial coaching for premium members.

Use Case:

Ellevest is perfect for women looking for a platform that understands gender-specific financial challenges, such as salary gaps and longer life expectancy. It’s also great for users looking for advice on budgeting, investing, and retirement planning.

How to Buy:

You can sign up for Ellevest’s financial services directly on their website or download the app from Google Play or the App Store.

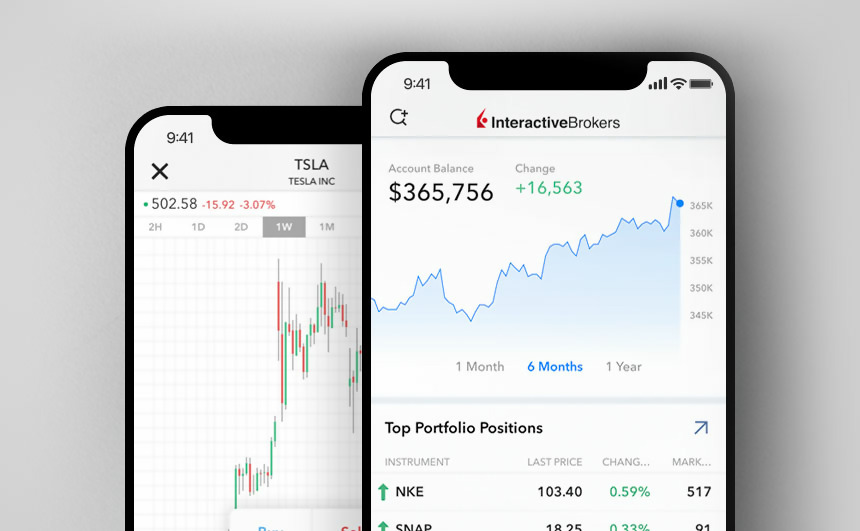

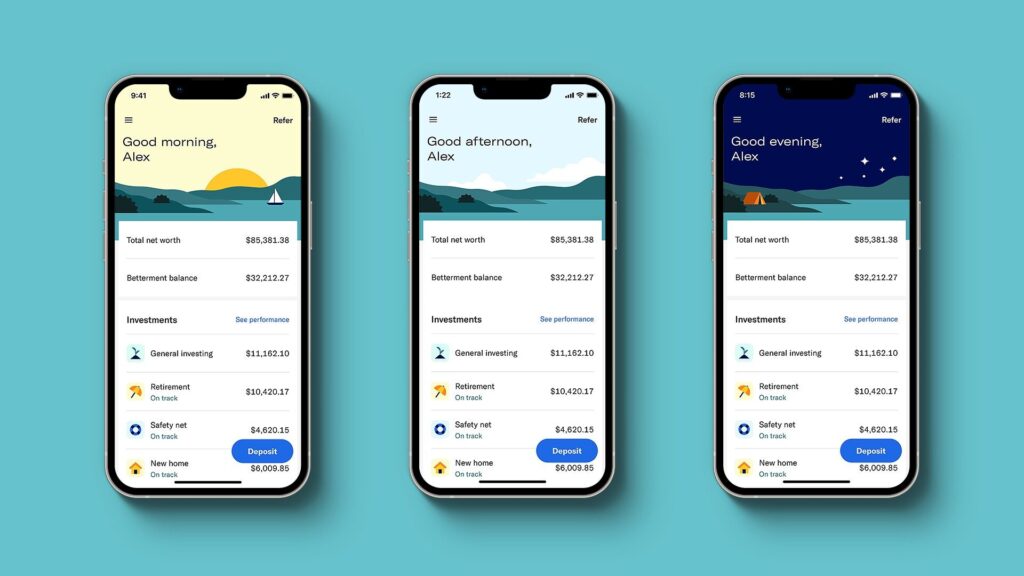

5. Betterment

Product Overview:

Betterment is a leading robo-advisor that provides personalized financial planning and investment management services. It offers automated portfolio rebalancing, tax-efficient investing, and access to certified financial planners.

Use Case:

Betterment is ideal for investors seeking low-cost, automated financial advice. It’s perfect for individuals who prefer a hands-off approach to investing but still want access to expert advice when needed.

How to Buy:

You can sign up for Betterment on their official website or download the app on the App Store and Google Play.

Key Financial Advisor Tips to Follow

Here are some essential financial advisor tips that can help guide your investment and financial decisions.

Set Clear Financial Goals

One of the most important tips financial advisors offer is the importance of setting clear, specific financial goals. Whether you’re saving for retirement, paying off debt, or building an emergency fund, having a goal gives you direction and helps you make informed financial decisions.

Diversify Your Investments

Another key tip is diversification. Financial advisors often recommend diversifying your investment portfolio to reduce risk. By spreading your investments across different asset classes (stocks, bonds, real estate, etc.), you’re less vulnerable to market fluctuations.

Invest for the Long Term

Financial advisors frequently emphasize the importance of long-term investing. Trying to time the market or reacting to short-term market fluctuations can lead to costly mistakes. Instead, focus on a strategy that will grow your wealth steadily over time.

How Financial Tools Solve Common Financial Challenges

The tools and platforms mentioned above offer solutions to a range of financial challenges:

- Lack of Financial Knowledge: Tools like Betterment and Personal Capital provide user-friendly interfaces that make complex financial concepts easy to understand, helping users gain confidence in managing their money.

- Limited Time: Robo-advisors such as Vanguard and Betterment automate the investment process, allowing busy individuals to grow their wealth without constant management.

- Retirement Planning: Tools like Fidelity and Vanguard provide specialized retirement planning services, helping users create long-term strategies for financial security.

- Wealth Management: Platforms like Fidelity Wealth Management offer tailored advice for high-net-worth individuals looking to preserve and grow their wealth over time.

Where to Access Financial Advisor Tools

You can access these financial tools directly from their official websites or download their apps from major platforms like Google Play or the App Store. Some of these tools offer free versions, while others may require a subscription or a fee for premium features.

FAQs

Q: How do financial advisors tailor advice to my specific needs?

A: Financial advisors typically assess your income, expenses, financial goals, and risk tolerance to offer personalized advice that fits your unique financial situation.

Q: Are robo-advisors as effective as human advisors?

A: Robo-advisors are great for automated portfolio management and can be very effective for those with straightforward investment needs. However, human advisors offer more personalized, nuanced advice, especially for complex financial situations.

Q: How often should I review my financial plan?

A: It’s recommended to review your financial plan at least annually or whenever there’s a significant life change, such as a new job, marriage, or buying a home.

In conclusion, financial advisor tips and tools provide invaluable guidance in navigating your financial journey. Whether you’re a novice investor or someone with considerable wealth, having access to expert advice and technology can help you achieve financial success in 2024 and beyond.

Comments are closed.