Best Tools and Apps to Help You Manage Your Money Effectively in 2024

Managing personal finances can be overwhelming, but with the right tools, it becomes a much more straightforward process. Whether you’re looking to budget, save for future goals, or get a clearer understanding of your spending habits, there are plenty of digital tools and products available to help. This article will guide you through some of the best products designed to help you manage your money more efficiently.

What is a Money Management Tool?

Money management tools, such as apps, software, and even certain services, provide users with the ability to budget, track expenses, set savings goals, and even manage investments. They can automatically categorize your spending, analyze your financial habits, and give you a clear picture of where your money is going each month.

These tools are essential for anyone looking to gain control over their finances, reduce debt, and plan for the future.

Benefits of Using Money Management Tools

By incorporating money management tools into your daily routine, you can:

- Increase Financial Awareness: By understanding your cash flow better, you’re able to make informed financial decisions.

- Track Expenses Automatically: Avoid the hassle of manually tracking your spending. Most apps automatically categorize your expenses.

- Simplify Budgeting: These tools help you create personalized budgets based on your income and spending patterns.

- Set and Achieve Financial Goals: Whether it’s saving for a house, vacation, or emergency fund, money management apps help you keep track of progress.

- Reduce Financial Stress: Knowing that you are in control of your finances can reduce stress and improve mental well-being.

Top 5 Products to Help You Manage Your Money

Here’s a look at five of the best tools and apps that can help you manage your money effectively.

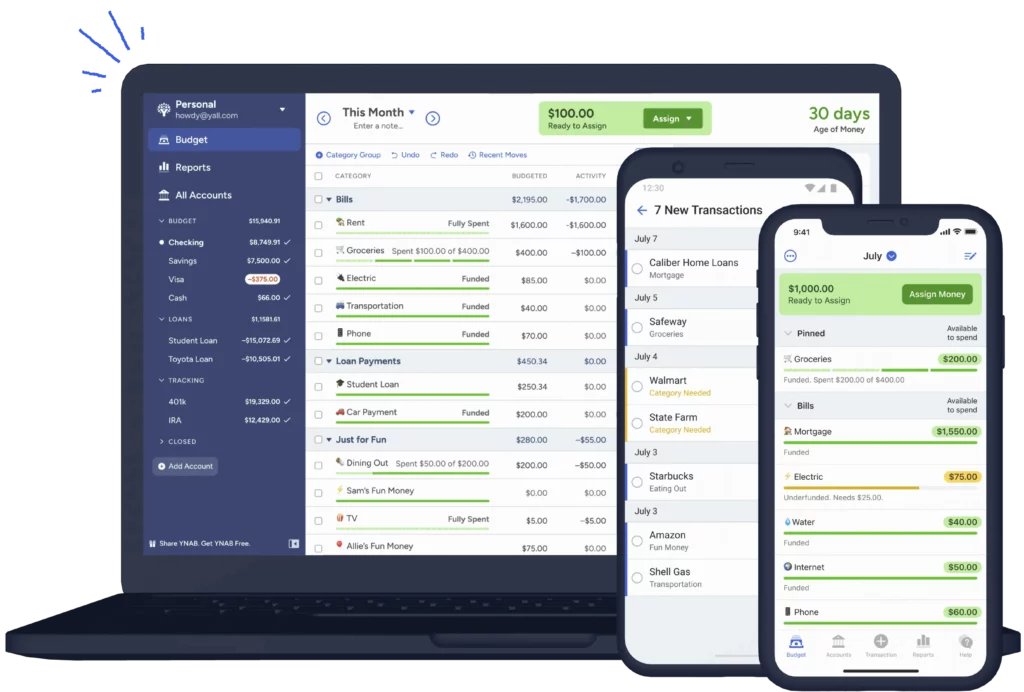

1. You Need a Budget (YNAB)

Product Overview:

YNAB is a popular budgeting app that follows a unique approach to managing money by allocating every dollar you earn to a specific purpose. It encourages users to be intentional with their spending and saves by setting clear priorities.

Use Case:

YNAB is especially useful for people who struggle with overspending and want to adopt a more disciplined approach to budgeting. It’s designed to help users take control of their money by forcing them to plan for every dollar that comes in.

How to Buy:

You can purchase YNAB through their official website or download the app on Google Play or the App Store.

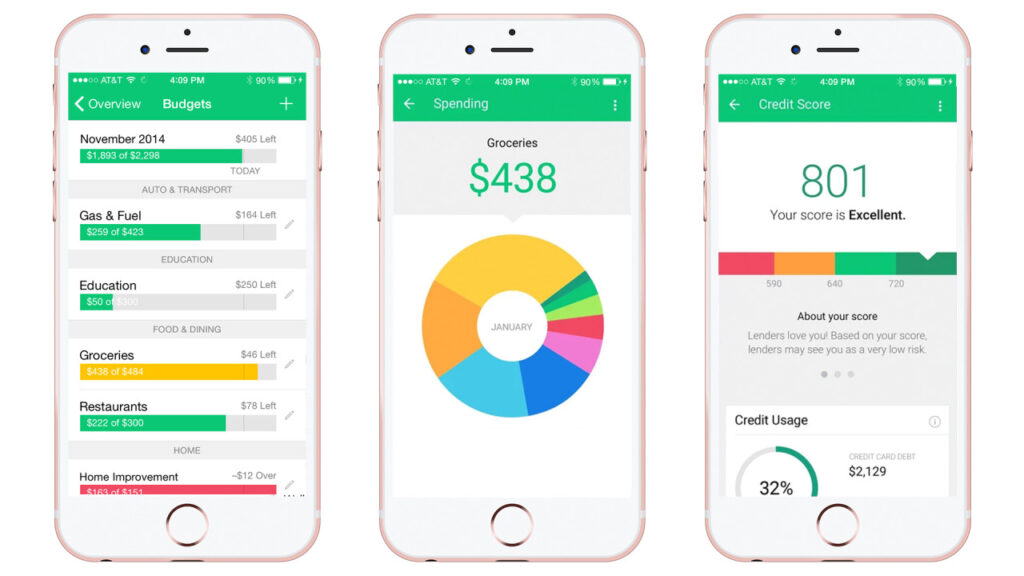

2. Mint

Product Overview:

Mint is one of the most popular free budgeting apps on the market. It automatically syncs with your bank accounts, credit cards, and other financial institutions to give you a complete view of your financial situation. The app offers personalized insights, bill tracking, and reminders to pay bills on time.

Use Case:

Mint is ideal for people looking for a free, all-in-one money management tool that covers everything from budgeting to bill payments. Its user-friendly interface makes it suitable for beginners who want an overview of their finances.

How to Buy:

Mint is a free app available on both the Google Play Store and the App Store.

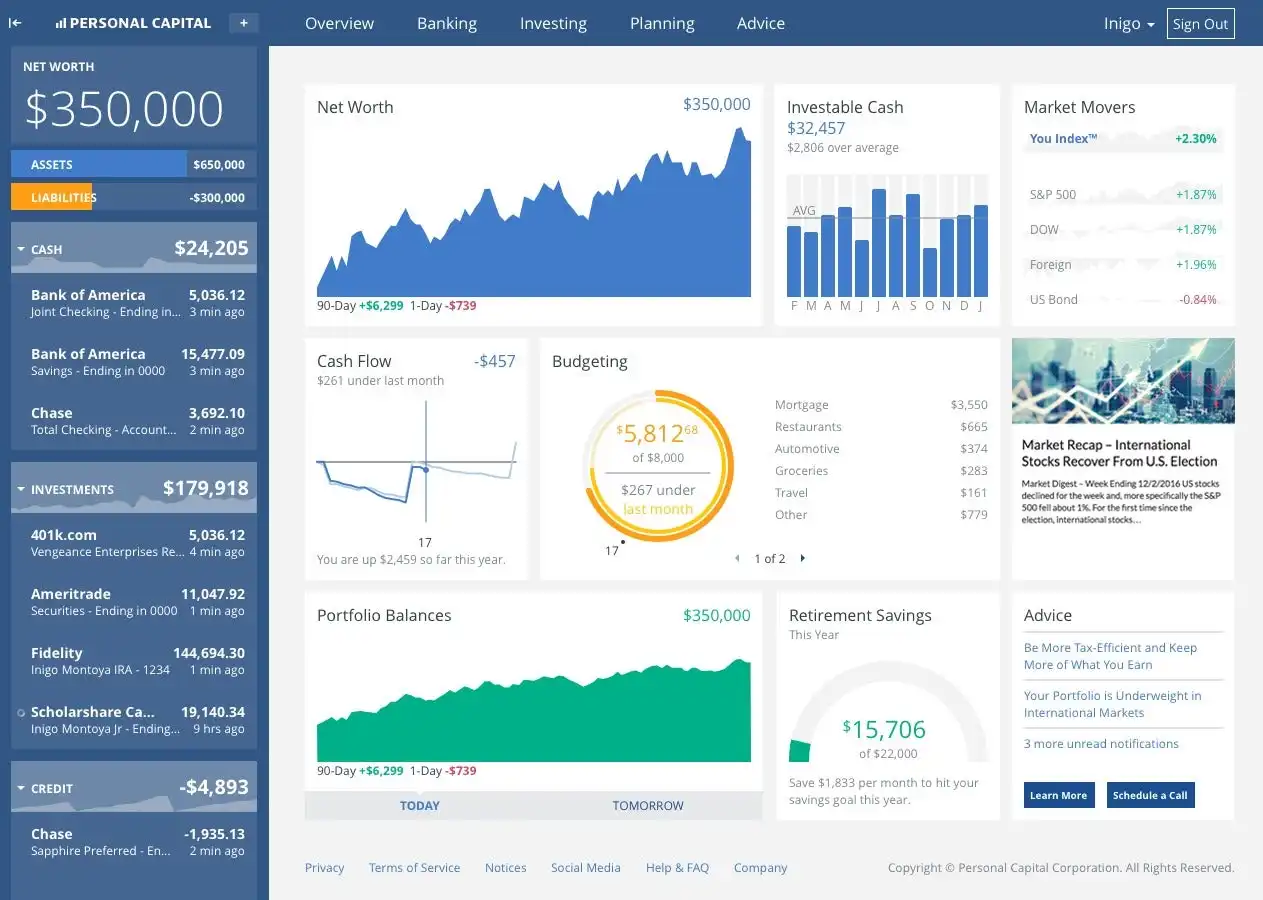

3. Personal Capital

Product Overview:

Personal Capital is a hybrid tool that combines personal finance management with investment tracking. The app allows users to monitor their budgets, savings, and investment portfolios in one place. It’s particularly suited for those who want to keep track of their net worth.

Use Case:

This tool is perfect for people who want to manage their day-to-day spending and keep a close eye on their investments. The platform offers comprehensive retirement planning tools, making it a great choice for those planning for their financial future.

How to Buy:

Personal Capital is free to use, with an option to purchase additional advisory services. The app is available for download on Google Play and the App Store.

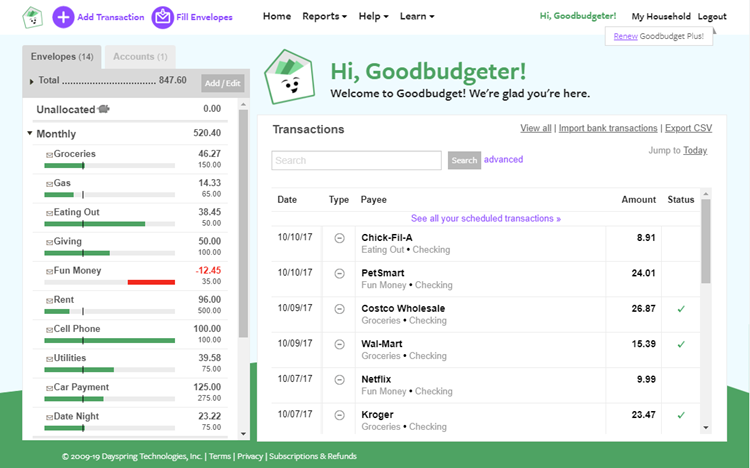

4. Goodbudget

Product Overview:

Goodbudget is a simple yet effective budgeting app based on the envelope budgeting system, where you divide your income into different spending categories (envelopes). The app encourages users to think carefully about how they allocate their money to different areas.

Use Case:

Goodbudget is excellent for people who prefer a more hands-on approach to budgeting and want to follow a structured plan for their monthly expenses. It’s great for couples and families who want to share a budget.

How to Buy:

Goodbudget offers both free and premium versions. You can download it on the App Store or Google Play.

<button>Start Using Goodbudget</button>

5. Acorns

Product Overview:

Acorns is an innovative app that rounds up your purchases to the nearest dollar and invests the spare change into diversified portfolios. It’s a great way to get started with investing without needing large sums of money.

Use Case:

Acorns is perfect for beginners who want to dip their toes into the world of investing while still maintaining a budgeting tool. It’s a hands-off approach to investing, making it ideal for people who don’t have the time to actively manage their investments.

How to Buy:

Acorns can be downloaded from the App Store and Google Play, with subscription tiers based on the features you need.

<button>Start Investing with Acorns</button>

How to Choose the Right Money Management Tool for You

Choosing the right tool depends on your specific needs and financial goals. Consider the following factors:

- Budgeting Needs: Do you need help tracking expenses or managing multiple accounts? Tools like Mint and YNAB might be the best fit.

- Investment Management: If you’re interested in tracking your investments, Personal Capital is an excellent choice.

- Beginner-Friendly Options: For simple money management, Acorns and Goodbudget are ideal for beginners who prefer a more structured approach.

Where to Buy and Download These Tools

You can download all of these apps directly from their respective websites, as well as through app stores such as Google Play or the Apple App Store. Many offer free versions, though premium features may require a subscription.

FAQs

Q: Which app is best for beginners?

A: For beginners, Mint and Acorns are great choices. Mint is user-friendly and free, while Acorns makes investing simple.

Q: Are these tools safe to use?

A: Yes, all the apps mentioned use bank-level encryption to secure your data, and they partner with trusted financial institutions.

Q: Can I link my bank accounts to these apps?

A: Yes, most of these tools allow you to link your bank accounts and credit cards for automatic tracking.

In conclusion, the right money management tool can make a significant difference in how effectively you manage your finances. Whether you’re trying to stick to a budget, save for a big goal, or get into investing, there’s an app out there that fits your needs perfectly.

Comments are closed.