Best Tools and Resources for Personal Investment Advice in 2024

Investing wisely is crucial for building long-term financial stability, but navigating the world of personal investment can be overwhelming. Whether you’re a beginner looking for guidance or an experienced investor seeking better tools, having access to quality investment advice can significantly impact your financial future. In this article, we will explore some of the best tools and products for personal investment advice, helping you make informed decisions that align with your financial goals.

What is Personal Investment Advice?

Personal investment advice refers to tailored financial guidance that helps individuals make informed decisions about where, how, and when to invest their money. Unlike generic investment tips, personal advice takes into account your specific financial situation, goals, and risk tolerance.

Having access to accurate and reliable investment advice can be the difference between growing your wealth and missing opportunities. In today’s digital age, there are various platforms, tools, and resources that provide personal investment advice, making it easier for anyone to take control of their financial future.

Benefits of Using Investment Advice Tools

Using investment advice tools and platforms can offer several key benefits:

- Customized Investment Strategies: Many tools provide personalized advice based on your financial situation, helping you create an investment plan tailored to your needs.

- Easy Access to Market Insights: Stay informed about market trends and opportunities with real-time data and expert insights.

- Diversification of Investments: These platforms often recommend a diverse portfolio to mitigate risk and maximize returns.

- Automation and Simplicity: Many investment tools offer automation features, allowing you to invest passively without needing constant management.

- Informed Decision-Making: Get access to educational resources, financial planning tools, and expert guidance that enable you to make smarter investment choices.

Top 5 Tools for Personal Investment Advice

Here’s a breakdown of five highly recommended platforms and products that provide personal investment advice and can help you build a profitable investment portfolio.

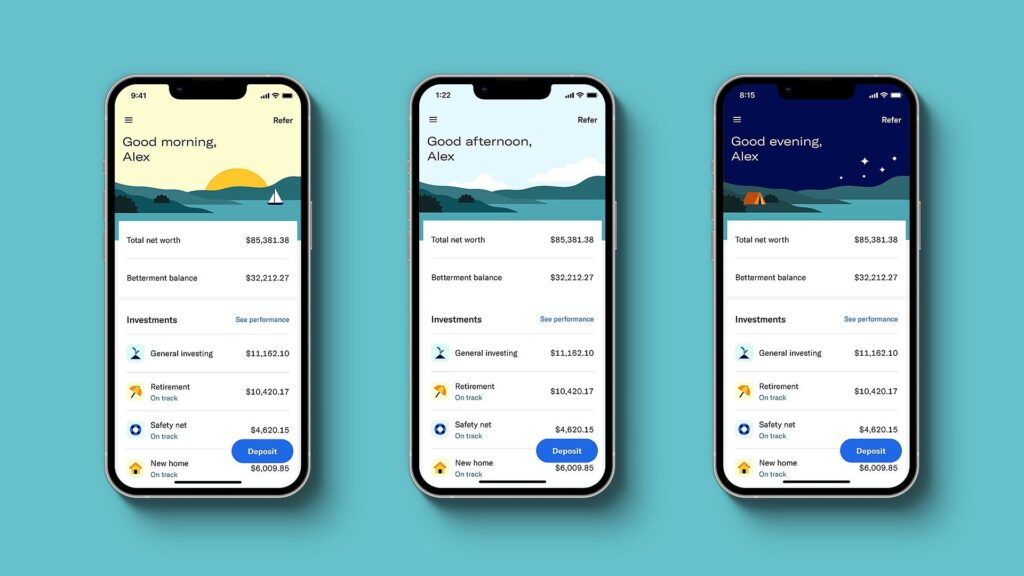

1. Betterment

Product Overview:

Betterment is one of the most popular robo-advisors on the market. It provides personalized investment advice using algorithms that tailor portfolios to your specific financial goals and risk tolerance. The platform offers automated rebalancing, tax-efficient investing, and financial planning tools.

Use Case:

Betterment is ideal for beginner investors who want a hands-off approach to investing while still receiving expert advice. It’s also suited for individuals who prefer low-cost, automated management of their investment portfolio.

How to Buy:

You can sign up for Betterment on their official website or download the app from the Google Play Store or App Store.

<button>Start Investing with Betterment</button>

Insert image of the product

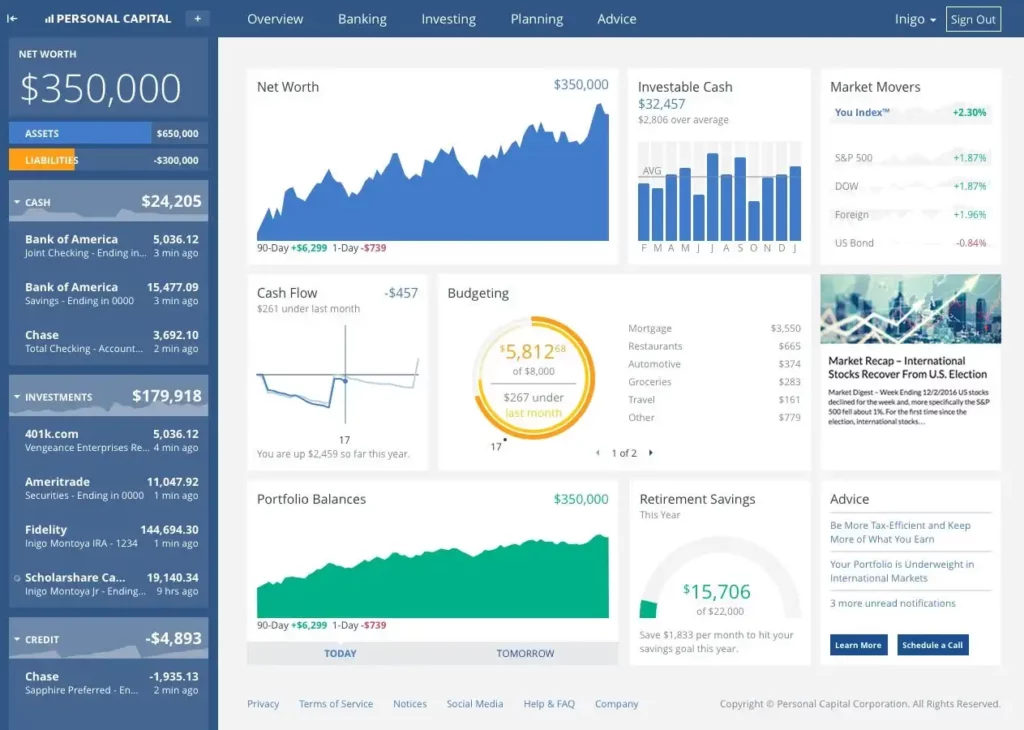

2. Personal Capital

Product Overview:

Personal Capital combines personal finance management with sophisticated investment tracking and advisory services. It offers a free financial dashboard that helps users track spending, plan for retirement, and get personalized investment advice based on their financial goals. The platform also provides wealth management services for higher-net-worth individuals.

Use Case:

Personal Capital is ideal for individuals who want comprehensive financial planning and investment management in one platform. Its detailed insights and advanced tools make it suitable for those looking to manage both their day-to-day finances and long-term investments.

How to Buy:

Personal Capital offers a free version of its app, with premium advisory services available for users with larger portfolios. You can download the app on Google Play or the App Store.

<button>Get Started with Personal Capital</button>

3. Vanguard Digital Advisor

Product Overview:

Vanguard Digital Advisor is a low-cost robo-advisor offered by Vanguard, one of the largest investment management companies in the world. The platform provides personalized investment advice and automates the management of your portfolio based on your financial goals and risk tolerance. Vanguard’s service is known for its low fees and long-term investment strategies.

Use Case:

Vanguard Digital Advisor is perfect for those looking for reliable, low-cost personal investment advice with a focus on long-term growth. It’s particularly suitable for retirement planning, as Vanguard specializes in retirement accounts and diversified investment portfolios.

How to Buy:

You can access Vanguard Digital Advisor through their official website. The platform is available to U.S. investors.

4. Ellevest

Product Overview:

Ellevest is an investment platform specifically designed to address the unique financial needs of women. It offers personalized investment portfolios, goal-based planning, and financial coaching. Ellevest also considers factors such as salary curves and life expectancy when tailoring investment advice to women.

Use Case:

Ellevest is ideal for women who want personal investment advice that takes into account gender-specific financial considerations. It’s great for goal-based investing, such as saving for retirement, purchasing a home, or building an emergency fund.

How to Buy:

Ellevest offers subscription-based services that can be accessed through their website. The platform is available as an app on both Google Play and the App Store.

5. Fidelity

Product Overview:

Fidelity Go is a robo-advisor from Fidelity Investments that provides personalized investment advice with no minimum account balance requirements. The platform helps investors build diversified portfolios based on their financial goals, time horizon, and risk tolerance. Fidelity Go also offers competitive fees and easy access to Fidelity’s vast array of financial products.

Use Case:

Fidelity Go is suitable for both new and experienced investors who want to benefit from a trusted financial institution’s low-cost robo-advisory services. It’s a great option for anyone looking to grow their investments over time with minimal fees.

How to Buy:

You can sign up for Fidelity Go directly through Fidelity’s website or app, available on Google Play and the App Store.

How to Choose the Best Personal Investment Advice Tool for You

When choosing an investment advice tool, consider the following:

- Cost: Some platforms, like Betterment and Vanguard Digital Advisor, offer low-cost options, while others may charge higher fees for premium services.

- Automation vs. Hands-On: Decide whether you prefer an automated approach, like robo-advisors, or more hands-on management.

- Financial Goals: Different platforms cater to various goals, such as retirement planning, short-term savings, or general wealth growth.

- Risk Tolerance: Choose a tool that aligns with your comfort level for investment risk.

Where to Buy and Download These Tools

All of the investment advice platforms mentioned in this article can be downloaded via app stores like Google Play or the Apple App Store. You can also sign up through their official websites. Some tools offer free versions, while others may charge a monthly or annual fee depending on the features you choose.

FAQs

Q: What is the best platform for beginner investors?

A: Betterment and Fidelity Go are great for beginners due to their low fees and automated portfolio management.

Q: Are robo-advisors safe to use?

A: Yes, robo-advisors use advanced encryption and secure measures to protect your personal and financial information.

Q: Can I get personalized advice through these platforms?

A: Yes, most platforms, like Personal Capital and Betterment, offer personalized investment advice based on your goals and financial situation.

In conclusion, having access to personal investment advice can empower you to make smarter, more informed financial decisions. Whether you’re looking to start investing or optimize your current portfolio, the right tools and resources can help you achieve your financial goals.

Comments are closed.